BLOGS

The Different Types of Mutual Funds

When it comes to mutual funds, you need to choose the ones that you are comfortable with the level of risk.

When it comes to investments, there are many options to choose from. Some will opt to start For some who are looking to cash into the stock market, financial instruments are the best way to go.

One of the most popular ones is a mutual fund. A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. For investors who wanted to start small or have individual access to professionally managed portfolios of equities, bonds, and other securities, mutual funds are the answer. Some of the most popular mutual funds offered in the Philippines invest in a number of securities, and their performance is usually tracked as the change of the mutual fund’s total market capitalization. When we say market capitalization, we refer to the total peso value (or total dollar value for some mutual funds) of the outstanding shares of a company’s stock. This is calculated by multiplying the total number of outstanding shares by the current market prices of one share.

Moreover, these mutual funds are operated by professionals, also called money managers. The goal of these money managers is to allocate the assets in a way to produce capital gains or income. The mutual fund’s assets are structured by money managers so as to match the investment objectives stated in its documentation, which is also known popularly as a prospectus.

But how are they different than investing in other assets, say buying a luxury house and lot for sale?

Mutual Funds: How Do They Work?

When investing in a mutual fund, you are also investing in an actual company. You are investing in partial ownership of the mutual fund company and its assets.

Confusing? Here’s a different perspective. Say you want to invest in ABC mutual fund. This means that you are investing in both the ABC mutual fund and its professionally managed portfolios of equities, bonds, and other securities. You are investing in a company that is in the business of making investments.

As an investor in ABC mutual fund, you can earn in the following ways:

1. Earn income from stock dividends and interest on bonds that are managed by the mutual fund’s portfolio. The mutual fund issues a payout of the income earned in the form of a distribution. You are given the choice of either receiving a check in the value of the income earned or reinvesting it back to the mutual fund for additional shares.

2. Earn capital gains from securities sold by the mutual fund. These securities are sold because they have increased in price. The capital gains are also passed on in a distribution.

3. If your holdings in the mutual fund increase in price, and that the money manager did not sell it, you have the option to sell it and gain a profit.

Most money managers are also owners of the mutual fund. The money manager is hired by a board of directors and is legally obligated to manage the mutual fund to the best interest of the investors, including you. Sometimes, mutual fund decisions are hedged on research and expert advice by analysts. The mutual fund has a fund accountant who is tasked to calculate the Net Asset Value (NAV), or the daily value of the mutual fund portfolio to determine whether shares prices have increased or decreased in value. A compliance officer is on standby, and a lawyer, to ensure that financial activities are up to government regulations.

Types of Mutual Funds

In the Philippines, some larger banks and financial institutions offer mutual funds. Most mutual funds are part of a much larger investment company. Five common types of mutual funds you will find in the local market are:

Money Market Fund

Also known as a Fixed Income Fund, this mutual fund can earn investors somewhere around 1-4 percent per year. When you invest in a Money Market Fund, your money is placed in a time deposit and other similar products with good interest rates. Money Market Funds are popular for people who wanted to put their money in a low-risk investment and have a short-term investment goal. And as always for low-risk investments, the returns are not as high as the other mutual fund types on this list.

Bond Fund

Bond Fund is another type of mutual fund that is considered a low-risk investment. Interest earned is similar to Money Market Fund. The difference is that the money invested in Bond Funds is placed in government bonds, investment-grade corporate bonds, and high-yield corporate bonds. Investors consider this mutual fund type because bonds are on the safer side of investments. If you have a short to medium-term goal, then investing in Bond Funds will be a great choice for you.

Equity Fund

Equity funds are high-risk mutual fund investments. Over the long term, they earn around 8 percent over the course of a period, sometimes higher. However, there may be years that Equity Funds do not earn as much, or even generate a negative income. When investing in an Equity Fund, your money is placed in the Philippine stock market. As such, the Equity Fund portfolio may consist of growth stocks, dividend stocks, value stocks, large-cap stocks, mid-cap stocks, small-cap stocks, or any combinations of these.

The level of risk in Equity Funds is due to the volatile nature of the stock market. Hence, these mutual funds are the riskiest type on the list. If you are looking to put some money on a long-term investment that can earn high interest for you, Equity Funds are your best bet.

Index Fund

Index Funds is another type of mutual fund that also invests in the stock market just like Equity Funds. The difference from the former is that the latter invest only in companies that are included in a particular index, hence the name. For example, investing in an index fund that tracks the Philippine Stock Exchange Composite Index (PSEI) means you are investing in the performance of 30 of the country’s “biggest” public companies from that list. This means that when the aggregate performance of the PSEI is high, that means higher returns for you and vice versa. For people who are looking into high-risk investments but have a long-term investment horizon, investing in an Index Fund is another investment route to consider.

Balanced Fund

Balanced Funds carry moderate risks. This is because Balanced Funds invest in both the money market and the stock market, so the risk is a little bit reduced. Money managers managing the fund invest half of the value in time deposits and bonds, and the other half is in the stock market. But the ratio is not always 50-50. Balanced Funds earn around 4 to 8 percent per annum on average. If you are willing to risk a little and can wait around 3 to 5 years, then Balanced Funds would be good for you.

Mutual Funds or Real Estate?

Mutual funds are a great way to earn income. Real estate, on the other hand, allows you to invest your hard-earned money in a physical asset that appreciates over time.

So the big question is this: should you go with mutual funds or with real estate? Choosing the type of investment that is right for you is not answered by selecting one over the other. It really depends on how you understand the risks involved and the investment horizon you are willing to bank on.

A mutual fund collects money from investors and invests the money on their behalf. The pool of money generated is invested in various assets. For people who do not know much about investing, mutual funds are a great way to start. Moreover, it does not require a lot of paperwork or stress to get started. Some banking facilities offer customers to select and invest in mutual funds online or via mobile app. Also, fund managers and the company that manages the mutual funds are obligated to make investment decisions that are for the benefit of investors like you for a small fee.

One of the biggest advantages of investing in mutual funds is risk diversification. Because you are pooling your resources with a bunch of other investors, you have the benefit of diversifying the risks in investing in the stocks, bonds, and other financial instruments in the portfolio with the capital outlay of your own choosing.

Real estate, on the other hand, is considered an asset with the highest returns that is unmatched by any other asset class. Real estate is less risky as it is a tangible asset and as a homebuyer, you have full control over your luxury house and lot. Plus, the demand for real estate is ever-growing, and history shows that the prices have always gone up sharply. This makes real estate one of the most favorable investment options to make.

If you are prepared to invest your hard-earned money, you probably want to put it in an asset that demands high rental yields. Suburban properties close to high-density locations will always be profitable in terms of rental income. The demand for exclusive properties, high occupancy rates, and continuous economic growth allows property investors to raise their rental income, especially if they bring something more than the usual. A smart real estate investor will certainly use this rental income to pay off extra towards the mortgage (and earn capital gain early in the process), and even cover expenses and maintenance during lull season.

As a tangible item, a luxury house and lot for sale allows you more control than other forms of investment, more so now when volatility in the stock market is seen by wise investors as an opportunity to reassess your asset allocations and reconsider how real estate can fit into your portfolio.

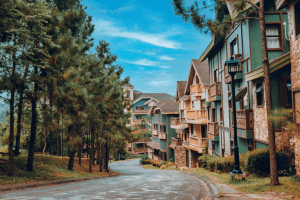

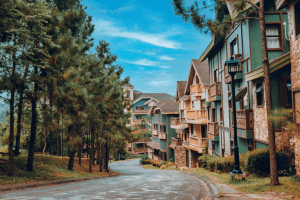

And with a community quarantine still in place in key areas, it seems a good idea to invest in properties located in lush mountainous areas. These locations serve as an idyllic retreat to relieve yourself of cabin fever by holing up in a secondary home that offers generous open spaces for leisurely walks, jogging, breathing in the fresh air, and observing physical distancing.

Investing in a high-value property in a prime location that appreciates over time can give you the financial security and investment return that you deserve.

Crosswinds Tagaytay is not just a luxury residential community – it has quickly become a beautiful, exclusive destination itself for both future homeowners and vacation renters alike. Imagine being surrounded by the sight and scent of over 35,000 pine trees, the picturesque view of the lush terrains of Tagaytay City, and the commanding Swiss-inspired homes, which are all situated along the natural slopes of the exclusive community. Overall, these make Crosswinds a truly breathtaking place. This hundred-hectare Swiss-inspired community, located in the coolest destination an hour outside of Mega Manila, offers panoramic views as the cool air braces and refreshes any exhausted soul. As a future homebuyer, it is easy to achieve living in a place where you can quickly take a break from the hustles and bustles of city life, and can still quickly get back to it.

Crosswinds Tagaytay is also home to a wide array of Swiss-themed properties that has attracted luxury property buyers to invest. Overall, what is not to like about owning a property at the only pine estate South of Metro Manila? Adding luxury real estate to your investment portfolio not only will help you grow your money, but also give you access to a lifestyle that is beautiful, luxurious, and convenient.

Find your next investment and your future permanent home at Brittany.

Next Read: Luxury Cruise Industry Resumes Operations in 2022

Next Read: Make Your LinkedIn Profile Attractive to Property Seekers

Next Read: The Luxury of Staying Connected with Nature at Alpine Villas

Next Read: Meet Lucerne, Your Luxury Dream Home

Next Read: Make a Gaming Room From Unused Space